Property Taxes: Investing Locally for Real Impact

Understanding the Connection Between Tax Policy and Disability Support

The Developmental Disabilities Resource Board (DDRB) is prohibited from using public funds to support or oppose any candidate or ballot measure. We are, however, allowed—and often asked—to explain how public policy proposals could affect the services we provide and the people we support.

The DDRB respects and appreciates the goal of making taxation fair, transparent, and equitable. We recognize the work lawmakers are doing to address those issues. The information outlined below is intended to provide clarity on how taxpayer contributions are used to support people with intellectual and developmental disabilities—and how those investments strengthen the St. Charles County community as a whole.

Senate Bill 3 (SB 3) is a state bill that could reshape how local property taxes work in Missouri.

These changes would reduce funding for services supported by property taxes, including local schools, libraries, fire protection, and the Developmental Disabilities Resource Board (DDRB) of St. Charles County, which funds essential services for people with intellectual and developmental disabilities (I/DD) and their families. This bill will be voted on by St. Charles County voters on April 7, 2026.

If approved, SB 3 would:

- Change how property tax revenues are calculated

- Freeze or cap property taxes, restricting future revenue growth and the ability to expand services.

As Missouri’s fastest growing county, the need for I/DD services will continue to grow.

It is estimated that as many as 7,2001,2 people in St. Charles County have an intellectual or developmental disability and may need access to DDRB-funded services supported by local property tax. In 2025, DDRB funding helped support 2,659 clients with critical services3. Nearly 25% of these individuals were those newly entering services.

How do I/DD services benefit the community?

- Empower people to gain and keep jobs and contribute to the local economy

- Give families the support they need to stay employed

- Create local jobs in caregiving

- Helps reduce reliance on emergency, institutional, or crisis-driven services

Sources:

1UMKC 2025 CRA Report Missouri Statewide Needs Assessment

2 https://www.census.gov/quickfacts/fact/table/stcharlescountymissouri/PST045224

3 DDRB FY’25 audit data

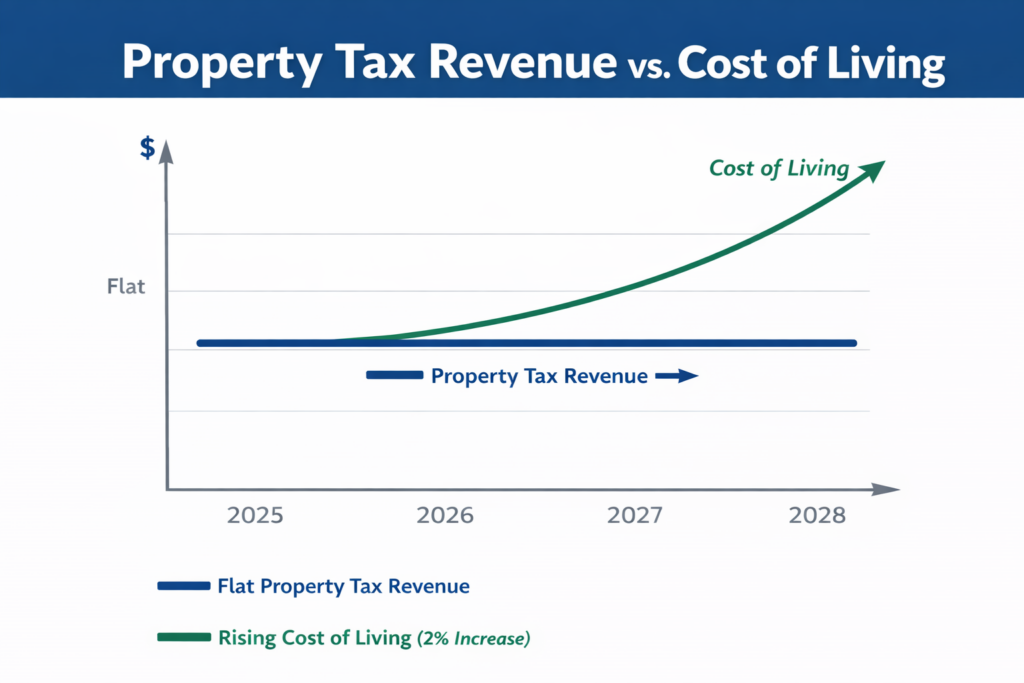

The impact of SB 3 isn’t just about the expansion of services — it’s about preserving what already exists.

If passed, SB 3 would lead to flat revenue indefinitely, regardless of rising costs and growing needs for those with intellecutal and developmental disabilities throughout our county. In the short-term, the anticipated impact is a $4 million dollar reduction in DDRB funding for disability services over the next 5 years1.

An average of 93% of DDRB tax revenue the last 5 years went directly to services for individuals with developmental disabilities1.

The remaining 7% is used to steward these dollars, assess needs to establish meaningful funding priorities, spread awareness on behalf of people with I/DD monitor quality and efficiency, act as a system player in our county on behalf of people with disabilities.

How is property tax funding used to support the local I/DD community?

- Support people in community-based settings rather than more costly alternatives

- Fill gaps not covered by other funding sources

- Prevent service disruptions

Source:

1 DDRB FY’25 data

The earlier people with intellectual and developmental disabilities receive essential services, the better the outcomes.

That’s part of the reason why in 1977 St. Charles County voters voted to support people with intellectual and developmental disabilities with property tax funding. Our County has a nearly 50-year history of recognizing the needs and contributions of people with intellectual and developmental disabilities in our community.

Organizations like the DDRB also play an active role in community planning, building provider capacity, and advocating on behalf of people with intellectual and developmental disabilities.

Source:

DDRB FY’25 Annual Report

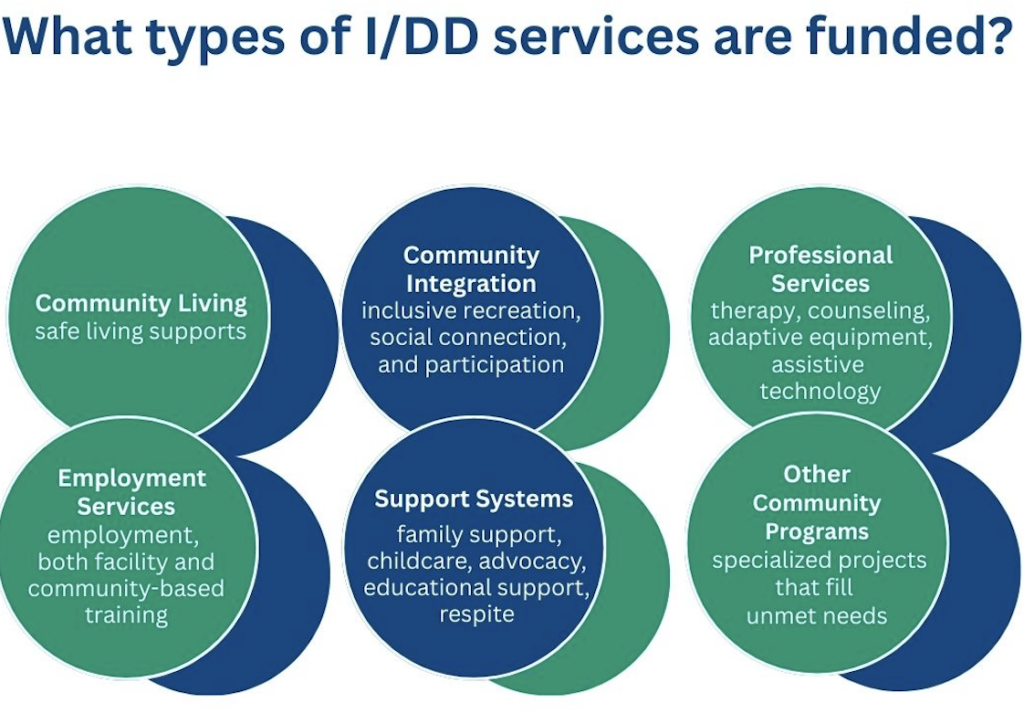

DDRB-funded services support people working and living safely in the community, professional services, and more.

These property-tax funded investments also help to reduce reliance on more costly emergency, institutional, or crisis-driven services by addressing needs earlier and more efficiently.

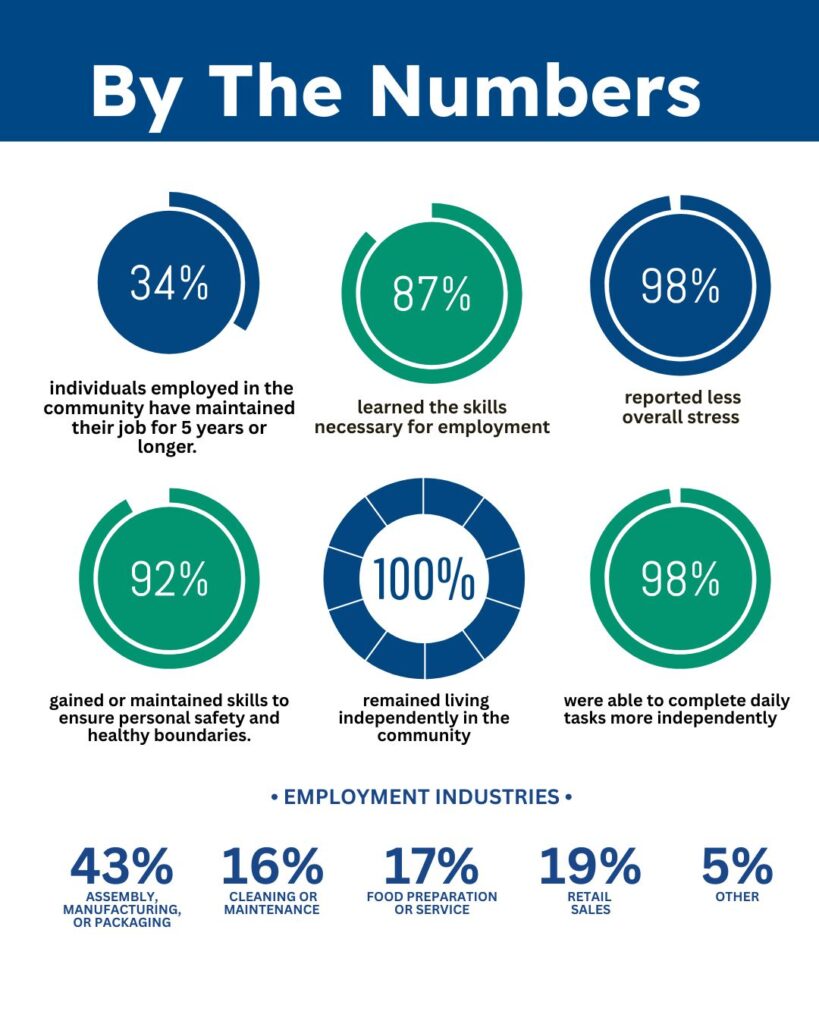

From an employment perspective, property tax funding:

- Keeps public dollars circulating in the local economy

- Supports a network of local service providers and frontline professionals

- Helps stabilize community-based organizations serving county residents

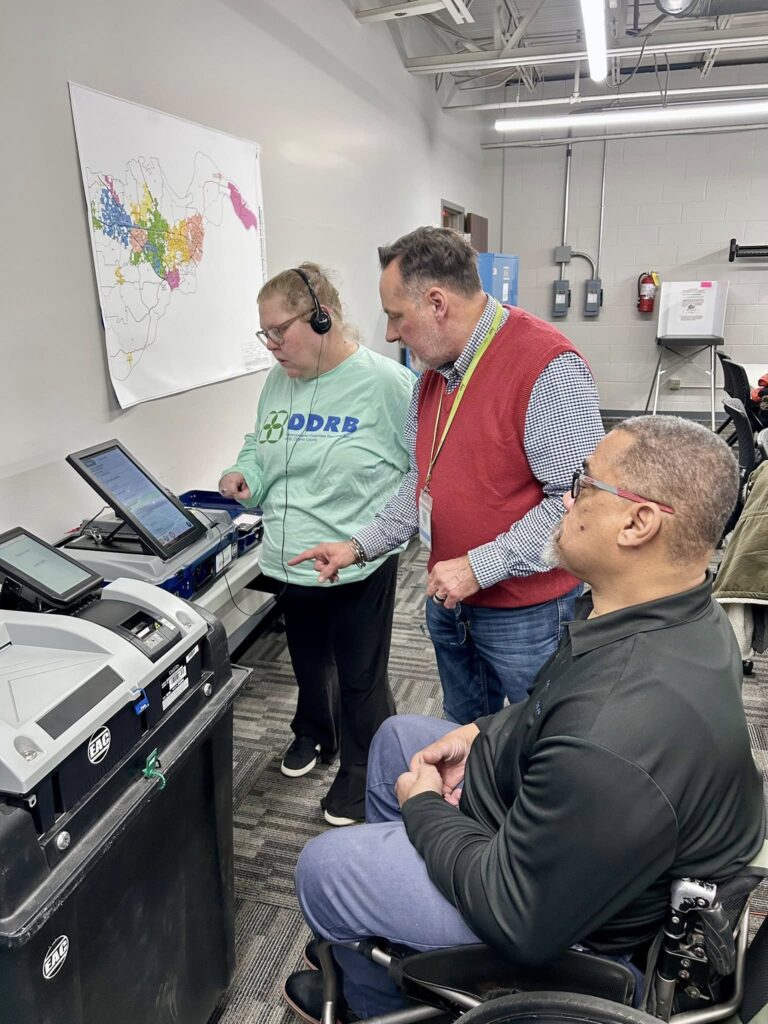

Accessible voting makes it possible for people with disabilities to vote independently and with confidence.

In St. Charles County, Missouri, voters have several options designed to remove barriers and provide support for people with physical disabilities or other accessibility needs. These options help ensure everyone can fully participate in the election process, including:

- Bi-Partisan Election Judge Assistance: Upon request, a bipartisan team of trained election judges can help you mark your ballot while maintaining voter privacy.

- Permanently Disabled Absentee Program: Voters with a permanent disability can be added to a mailing list so that ballot request forms are automatically sent before each election. Ballots can then be completed and returned by mail or in person.

- Curbside Voting: Voters with limited mobility can vote from their vehicle both before and on Election Day. A bi-partisan team of election staff will bring a ballot to your car and assist you with the process while protecting your privacy.

- Hospitalization Voting: If you’re hospitalized and unable to reach the polls, you can request that election officials bring a ballot to you in the hospital.

- Accessible Voting Systems: Every polling location is equipped with accessible voting machines (e.g., ballot-marking devices with touchscreens, audio assistance, enlarged text, or sip-and-puff controls) that meet ADA standards, so voters with a variety of needs can cast their ballots independently.

- Bi-Partisan Election Judge Assistance: Upon request, a bipartisan team of trained election judges can help you mark your ballot while maintaining voter privacy.

More broadly in Missouri, accessible voting also includes rights under the Americans with Disabilities Act (ADA), like wheelchair-accessible booths, audiovisual voting options, and the ability to bring someone to assist if needed.

Accessible voting options help make elections inclusive, equitable, and fully accessible to all registered voters.

Learn more information at: https://sccmo.org/2326/Accessible-Voting

Why this matters to Taxpayers?

Local dollars support practical, everyday needs to help drive positive outcomes:

- People working

- People living safely in the community

- People accessing supports and professional services

- Investments help reduce reliance on emergency, institutional, or crisis-driven services

- Decisions are made locally, based on community needs and accountability

For questions or additional information, please contact info@DDRB.org